From ICE to Software-Defined Vehicles: Lessons the Motorcycle Industry Can Learn from Automotive

6 Minutes Read

In an era where technology shapes every aspect of daily life, the motorcycle industry can no longer rely on incremental innovations alone. Modern consumers, especially millennials and Gen Z, are deeply tech-savvy and expect their vehicles to deliver experiences on par with smartphones and cutting-edge consumer electronics. Advanced connectivity, smart features, and seamless digital integration increasingly influence buying decisions. This shift drastically raises the bar for motorcycle industries to deliver not just improved engines or sleeker designs, but vehicles that are software-defined, digitally connected, and constantly evolving.

Automotive giants and new Electric Vehicle (EV) startups alike are adopting innovations from diverse industries: aerospace materials for lighter frames, IT driven software platforms, and telecom-based connectivity. Companies like Stark Future and BYD are redefining market standards by rapidly integrating these cross-industry technologies.

This cross-industry adoption has helped cars evolve into software-defined machines that are safer, smarter, and more profitable for manufacturers. Motorcycle OEMs can no longer afford to ignore this transformation. Several established automotive and motorcycle OEMs serve as cautionary tales for the risks of failing to adapt to technological change. Here are notable examples:

- Saab (Sweden)

Once a respected innovator, Saab failed to keep up with advancements in electronics, connectivity, and emissions technology. Ultimately, the inability to invest in new tech and remain competitive led to bankruptcy and the brand’s exit from the market. - Pontiac, Oldsmobile, Saturn (USA)

These iconic General Motors brands struggled with slow product cycles, outdated designs, and resistance to digital transformation. As consumer preferences shifted toward tech forward vehicles, GM retired these brands due to declining sales and technological relevance. - Bimota (Italy)

Celebrated for high-performance sportbikes and engineering innovation, Bimota faced repeated financial difficulties due to a limited product portfolio, lack of large-scale investment in modern electronics and connectivity, and slow adaptation to global market trends. Bimota’s decline illustrates the risk of underinvesting in key technologies and not aligning with the digital transformation shaping the industry. - UM Motorcycles (USA/India)

UM Motorcycles’ attempt to expand globally, particularly into Asia, faltered due to quality issues, insufficient local R&D, delayed product innovation, and an inability to meet rising customer expectations for advanced features. UM ultimately exited several major markets, including India, after being unable to keep pace with more agile, tech-savvy rivals.

With increasing regulatory scrutiny, growing consumer demand for connected experiences, and competition from nimble EV startups, this blog will explore how the motorcycle industry can successfully adopt cross-industry technologies, learn from leading EV innovators, and avoid the pitfalls of legacy brands that failed to evolve.

Why Motorcycles Need to Make This Shift Now

The motorcycle industry, long known for its blend of mechanical craftsmanship and innovation, is now at a pivotal moment. It’s facing key engineering challenges and breakthrough opportunities that require swift change to keep up with today’s demands for better performance, improved safety, and greater environmental responsibility.

- Regulatory Stringency is No Longer Negotiable

Global emissions and safety frameworks are tightening with unprecedented speed. Advanced regulatory requirements now mandate more than just cleaner engines; they require integrated electronic control units (ECUs) capable of precision emissions management, real-time diagnostics, and sophisticated rider assistance systems such as adaptive cruise control, collision mitigation, and electronic stability control. Failure to comply is not an option, especially as regulatory bodies begin imposing steep fines and market access restrictions. Special interest OEMs, historically slow to integrate such technologies, must urgently accelerate beyond mechanical tweaks to meet these non-negotiable benchmarks. - Consumer Expectations Have Evolved Beyond Hardware

Today’s riders, especially millennials and Gen Z, view their motorcycles as extensions of their digitally connected lifestyles. Expectations have shifted dramatically: riders demand personalized, seamless digital experiences encompassing smartphone integration, over-the-air software updates, modular hardware enhancements, and intuitive, interactive dashboards beyond the legacy analog or simple LCDs. This is particularly pressing for special interest OEMs like Harley, Triumph, and Ducati, whose core demographic is aging and shrinking; failing to modernize the user experience risks total alienation from future generations who prize technology as highly as style and heritage. - Disruptive Competitive Threats Are Reshaping Market Dynamics

Agile startups focused on EVs and smart connectivity, such as Stark Future, Zero Motorcycles, Infinite Machines, and Lightning Motorcycles, are using modular architectures and software-first platforms to enable rapid innovation and more advanced rider experiences. These innovators attract younger consumers by providing tech-enabled personalization, smartphone apps, integrated telemetry, and new vehicle-to-infrastructure connectivity. If traditional OEMs continue to rely on legacy E/E architecture, fragmented proprietary software stacks, and long vehicle development cycles, they risk losing market share and cultural relevance to these agile competitors who are built for the digital age.

The Stark Consequence for Special Interest OEMs

Ignoring this shift is no longer a hypothetical risk; it is an existential threat. Iconic brands like Harley-Davidson, KTM, and BMW, whose equity is deeply rooted in culture and legacy, face accelerated decline if they do not embrace connected, software-defined motorcycles that resonate with modern consumers. The marketplace will no longer tolerate product lineups that lag in connectivity, rider aids, or emission compliance. Legacy prestige cannot defend against obsolescence. Without an aggressive pivot to integrated digital architectures and cross-industry technology adoption, these brands risk:

- Rapid attrition of their core demographic without replacement.

- Loss of license to operate in stricter markets due to regulatory non-compliance.

- Erosion of brand relevance as competitors win over tech-savvy riders.

- Financial and strategic vulnerability from missed innovation cycles.

In essence, the future belongs to the bold who embrace digital transformation. Failing to evolve now means risking irrelevance in a technology-driven market where innovation defines the future of iconic brands.

Technologies That Accelerated Automotive Evolution

The automotive industry’s dramatic transformation over the past decade is largely driven by the adoption of innovations from diverse sectors, including aerospace, information technology, telecommunications, and consumer electronics. Here’s how cross-industry technologies have helped automotive manufacturers leap forward, supported with clearly marked sources for rapid readability.

Aerospace Contributions: Precision and Safety

- Drive-by-wire and brake-by-wire systems

Originated in aviation, where electronic controls replaced mechanical linkages for accuracy. Cars adopted similar systems to enable advanced driver-assistance features (ADAS) and enhance braking efficiency. - Lightweight composite materials

Lightweight composite materials and aluminum alloys came directly from aircraft manufacturing, significantly boosting fuel efficiency without sacrificing safety. - Functional Safety Engineering

Adopted from aerospace, functional safety engineering ensures that vehicle systems meet rigorous safety standards through systematic risk assessment and fault mitigation. - Model-Based Development

This approach uses detailed virtual models to design, simulate, and validate complex systems early, reducing development time and improving system reliability. - Certification Processes

Aerospace-grade certification ensures vehicle components and systems comply with strict safety and performance regulations, boosting consumer trust and regulatory acceptance. - Redundancy and Failover Systems

Inspired by aviation, multiple backup systems and automatic failover mechanisms enhance vehicle safety by ensuring continuous operation despite component failures.

For example, Jaguar Land Rover utilizes advanced lightweight metals and composites developed for aerospace to improve vehicle efficiency and performance in models like the Jaguar I-PACE EV.

IT & Software Industry Influence: Agile and OTA

- Over-the-Air (OTA)

The OTA updates were inspired by how smartphone operating systems are deployed. Today, Tesla and BMW deliver software patches and paid feature upgrades directly to vehicles, saving millions on recalls. - Agile and DevOps

Agile and DevOps practices, common in IT companies, replaced traditional waterfall development cycles in automotive. This change enabled continuous software updates, reducing the time-to-market for infotainment, battery management, and ADAS systems. - Cloud Computing & Edge Computing

Combining cloud-based analytics with local edge processing enables real-time data handling, faster decision-making, and seamless OTA updates for improved vehicle performance and safety. - Service-Oriented Architecture (SOA)

Enables modular, interoperable software components that can be independently developed and updated, accelerating innovation and simplifying integration across complex vehicle systems. - Virtualization & Hypervisors

Facilitate running multiple isolated software environments on shared hardware, improving resource utilization, security, and speeding up deployment of new features. - Data & Analytics Infrastructure

Supports collection and analysis of vast vehicle and user data, driving predictive maintenance, personalized services, and strategic product improvements. - Cyber Security

Protects connected vehicle systems and sensitive data from cyber threats through multi layered defenses, ensuring trusted and safe software-driven mobility.

For example, Renault employs a software-defined platform with a central computer and dedicated Car OS, enabling ongoing updates, feature additions, and enhanced data processing in new Renault vehicles developed through partnerships with Qualcomm and Google.

Telecom Integration: Real-Time Communication

- V2X (Vehicle-to-Everything):

V2X communication adopted telecom-grade protocols to enable real-time interactions between vehicles, infrastructure, and pedestrians, essential for safety and traffic management. - 5G Integration

The 5G integration lowered latency, paving the way for autonomous driving and high-speed data exchange. - Network Protocols & Data Management:

MQTT provides lightweight, efficient messaging for real-time telemetry and command exchange in connected vehicle ecosystems. - CoAP and HTTP/2 protocols:

Facilitates secure, scalable, and flexible communication between devices and cloud services in motorcycle telematics. - Billing and Subscription systems:

Eenable seamless management of user subscriptions and usage-based billing, supporting new revenue streams. - Service Monetization:

It leverages connected vehicle data and telecom integration to create value-added services, enhancing profitability and customer engagement.

For example, vehicles supporting 5G, such as the BMW iX, can perform over-the-air updates and offer real-time connected features like traffic data and fleet management, leveraging telecom innovations for enhanced safety and user experience.

Consumer Electronics Inspiration: UX and Energy Management

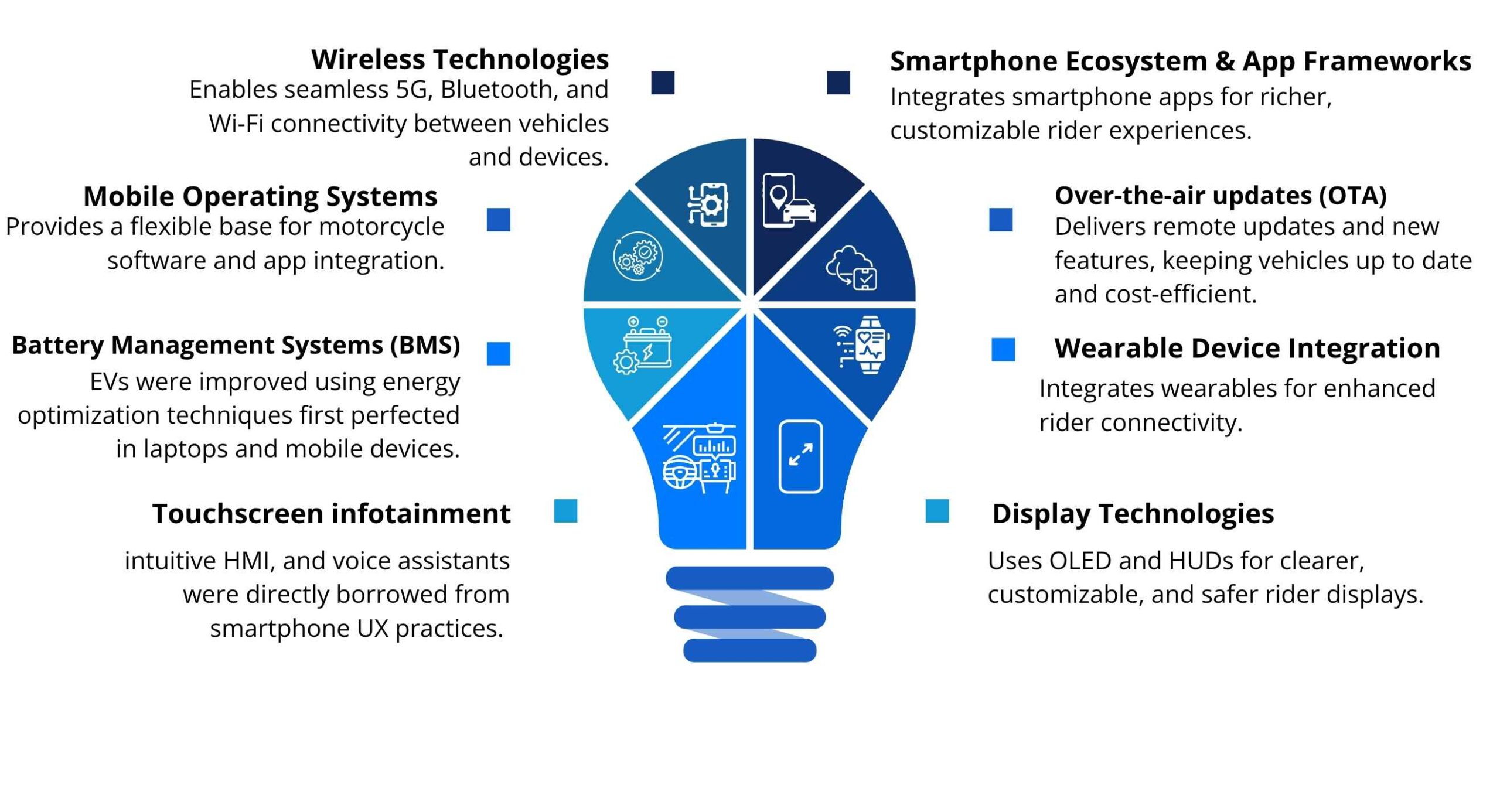

- Touchscreen infotainment, intuitive HMI, and voice assistants were directly borrowed from smartphone UX practices.

- Battery Management Systems (BMS) for EVs were improved using energy optimization techniques first perfected in laptops and mobile devices.

- Mobile Operating Systems

These platforms provide a versatile foundation for motorcycle software, enabling integration of apps, services, and standardized interfaces familiar to users. - Wireless Technologies

Advanced wireless connectivity (e.g., 5G, Bluetooth, Wi-Fi) ensures seamless communication between vehicles, cloud services, and user devices for enhanced functionality. - Smartphone Ecosystem & App Frameworks

Leveraging smartphone app ecosystems allows motorcycles to support rich third-party apps and services, improving user experience and customization options. - OTA

Over-the-air updates enable remote delivery of software improvements, bug fixes, and new features, reducing costs and keeping vehicles up to date throughout their lifecycle. - Wearable Device Integration

Connecting wearable devices enhances rider safety and convenience by enabling hands-free notifications, health monitoring, and real-time communication. - Display Technologies

Innovative display tech, such as OLED and HUDs, improves rider information delivery with clearer visuals, customizable interfaces, and safer, glanceable data access.

For example, the Chevrolet Volt, a Plug-in hybrid using lithium-ion batteries for its electric drive segment, was introduced by GM as a mainstream application of this technology.

The results are clear: standardized software stacks, centralized hardware architectures, and data-driven services have turned cars into mobile tech platforms, generating recurring revenue through subscriptions and cutting production costs.

What Motorcycles Can Borrow from the Automotive Industry

The technology transfer from automotive to motorcycles does not need to be experimental. Several proven approaches can deliver immediate business value.

- Standardized Software Platforms

Automotive-grade platforms like AUTOSAR standardized how ECUs communicate and allowed

software reuse across models. A similar lightweight and optimized framework for bikes would:- Reduce duplication of development efforts across models.

- Enable faster rollout of connected and safety features.

- Cut long-term maintenance costs by ensuring modularity.

- Centralized E/E Architecture and Sensors

Motorcycles still rely on multiple microcontrollers for engine, ABS, and infotainment. Shifting to

centralized domain controllers, the strategy now common in cars would:- Lower the Bill of Materials (BoM) by reducing hardware redundancy.

- Improve processing power for real-time rider assistance features like traction control,

adaptive cruise, and battery optimization. - Simplify OTA updates, as all systems are managed from a single computing unit.

- Additionally, lightweight composites and automotive-grade sensors can significantly

improve performance and energy efficiency in electric motorcycles.

- Software-Defined Vehicles (SDV)

SDV adoption requires both centralized hardware and standardized software platforms and

paves the way for agile, customer-driven innovation.- Enable new features (ride modes, safety aids) through software rather than physical

component changes. - Allow for rapid post-sale upgrades and personalization, mirroring what’s possible in modern

cars. - Support continuous deployment and improvement cycles, turning the bike from a static

product into a platform that evolves throughout its lifecycle. - Remote software upgrades for safety and performance tuning.

- Subscription-based add-on features (custom ride modes, navigation services).

- Predictive maintenance alerts reduce warranty and service costs.

- Enable new features (ride modes, safety aids) through software rather than physical

- Agile and Cloud-Enabled Development Processes

Traditional motorcycle development cycles often stretch over 3-4 years. By adopting Agile DevOps practices and cloud-based testing environments already standard in automotive, OEMs can:- Implement Continuous Integration and Continuous Deployment (CI/CD) pipelines to automate build, test, and release cycles, accelerating development and ensuring higher software quality.

- Cut validation time using Hardware-in-the-Loop (HIL) and simulation-based testing.

- Deploying firmware improves faster, critical for EVs where battery optimization is a recurring need.

Proven Impact: Automotive as the Clear Winner

The numbers make a compelling case:

- Time to Market: 30-40% reduction in time-to-market for new models by adopting agile processes and standardized software platforms.

- Significant Cost Savings: Tesla’s centralized ECU architecture reduced hardware costs by consolidating ~70 ECUs into fewer domain controllers.

- New Revenue Streams: OTA (Over-the-Air) updates allow automakers to deliver software improvements and new features remotely, leading to substantial cost reductions and operational benefits:

- Recall Cost Savings: OTA updates can cut recall costs by up to 90% by enabling remote software fixes instead of expensive physical recalls. Automakers saved an estimated $35B in 2022 through OTA versus traditional methods.

- Maintenance Efficiency: OTA resolves up to 80% of software-related issues remotely, slashing service visits and downtime for drivers.

- Connected Vehicle: Platforms like AWS IoT FleetWise process millions of diagnostic data points daily using Cloud diagnostics and Remote Diagnostics to enable real-time fleet health monitoring at scale. This allows early fault detection, reduces unplanned downtime by up to 40%, and resolves up to 80% of issues remotely, minimizing service visits.

- Cloud and Remote Diagnostics: The use of cloud and remote diagnostics through over-the air (OTA) updates enables routine enhancement of everything from user interfaces to powertrain and safety features. These technologies also allow new capabilities, such as

“Autopilot” enhancements, to be added after purchase while constantly monitoring and improving vehicle health remotely. - Market Growth & Reach: The global automotive remote diagnostics market is projected to soar from around $19.2B in 2024 to $65.9B by 2032, with a robust CAGR of 16.7%. This growth highlights widespread adoption of industry, especially as connected and electric

vehicles become standard. - Operational Benefits: Cloud diagnostics and Remote Diagnostics enable real-time monitoring and early fault detection, reducing unplanned downtime by up to 40% for large fleets and enabling up to 80% of vehicle issues to be resolved remotely, minimizing costly dealer visits and service interruptions.

The same playbook can be applied to bikes, particularly in premium and EV segments, where riders are willing to pay for differentiated digital experiences.

How ElectRay Can Accelerate This Transformation

Motorcycle OEMs don’t have to start from scratch. Partnering with technology experts who already understand automotive grade platforms can significantly reduce transition risks.

- Ready-to-use production-grade software stacks developed for automotive use can be adapted for motorcycle ECUs, reducing development times by 25-30%.

- Software-Defined Motorcycles: Transitioning to software-defined architecture enables rapid feature updates and customization, enhancing user experience and market responsiveness.

- Software & E/E Architecture Integration for Motorcycles: Integrating advanced software with electrical/electronic (E/E) systems simplifies design, ensures compatibility, and supports efficient manufacturing.

- Motorcycles Diagnostics & Remote Health Monitoring: Real-time diagnostics and remote health monitoring reduce maintenance costs by detecting issues early and minimizing downtime.

- Cybersecurity: Robust cybersecurity measures protect motorcycle ECUs and connectivity features from hacking, ensuring rider safety and data privacy.

- Functional Safety: Certified functional safety solutions help meet regulatory standards, reduce risk, and ensure reliable system performance under all conditions.

- Cloud-based testing decreases reliance on costly physical prototypes.

- Consulting on modular hardware-software architecture ensures long-term savings through component reuse across multiple models.

ElectRay’s extensive expertise in automotive standards like AUTOSAR and ISO 26262 guarantees safety and compliance for critical motorcycle systems. Its experience with OTA deployment, connected features, and EV BMS optimization can help motorcycle OEMs accelerate the launch of competitive, future-proof products.

ElectRay’s Customer Success Story: Cloud and Remote Diagnostics for Motorcycles

ElectRay has empowered motorcycle OEMs with advanced cloud-based and remote diagnostic solutions, enabling real-time monitoring and fault detection. Their technology facilitates seamless data transmission from vehicles to cloud platforms, allowing real-time diagnostics, remote diagnostics, and instant alerts. This improves rider safety, reduces downtime, and enhances after-sales service efficiency. These capabilities are powered by ElectRay’s proven, ready-to-use, production-grade software stacks, including UDS Stack and Flash Bootloader which ensure standardized communication, secure flashing, and reliable ECU to Cloud integration. By integrating robust security and OTA update capabilities, ElectRay helps motorcycle manufacturers elevate user experience and operational reliability in today’s connected mobility world.

Conclusion: The Next Decade Belongs to Those Who Act Now

The motorcycle industry cannot afford to follow a slow, mechanical, and hardware-first innovation cycle while the world moves toward software-defined mobility. Automotive success demonstrates that cross-industry adoption is not just an R&D strategy; it’s a business necessity.

Motorcycle OEMs that adopt standardized software, centralized hardware, cloud-enabled testing, and connected ecosystems will not only reduce costs and accelerate launches but also create new revenue streams.

With partners like ElectRay, moving to connected, intelligent Software Defined Motorcycles is simple and cost-effective. Their ready-to-use production-grade software stacks, proven cloud diagnostics, and OTA expertise ease the shift to centralized software platforms, enabling faster innovation and improved rider experience. The technology is ready; it’s time to shift gears.

Read Our White Paper On: – Riding the Future: A Practical Guide to Software-Defined Motorcycles